DC Pulse // 3Q 2025 in Review

Research, regulations, returns and trends in DC

-

MFS DC Takes

MFS DC Takes

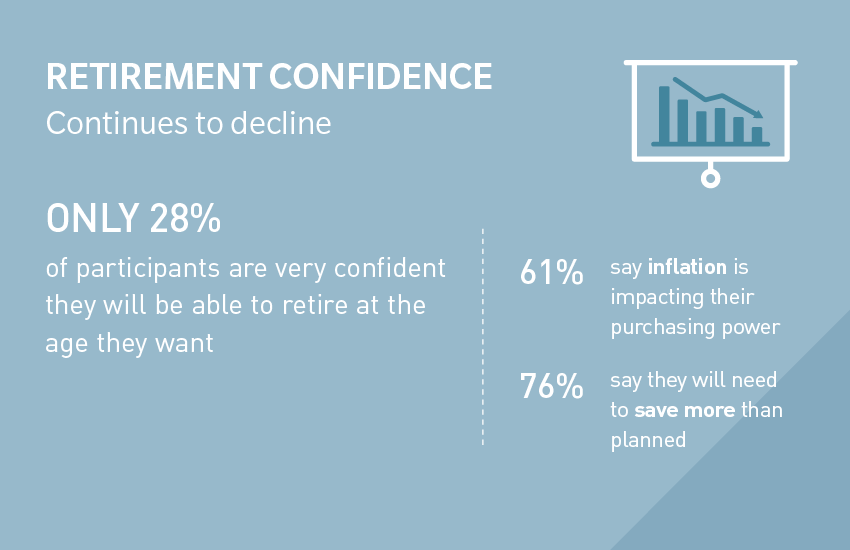

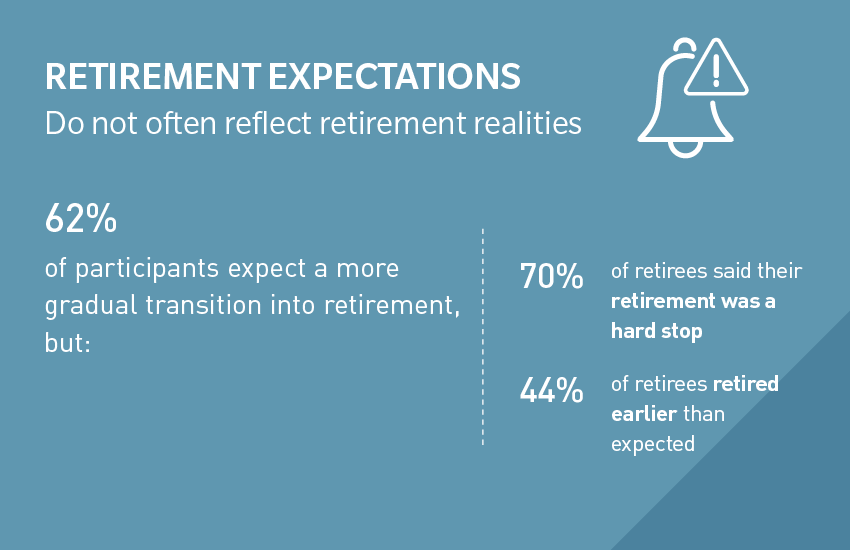

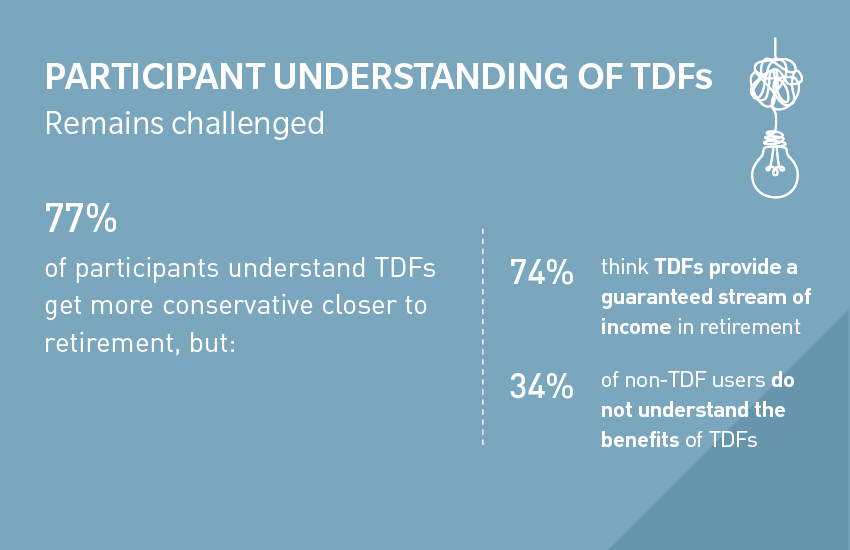

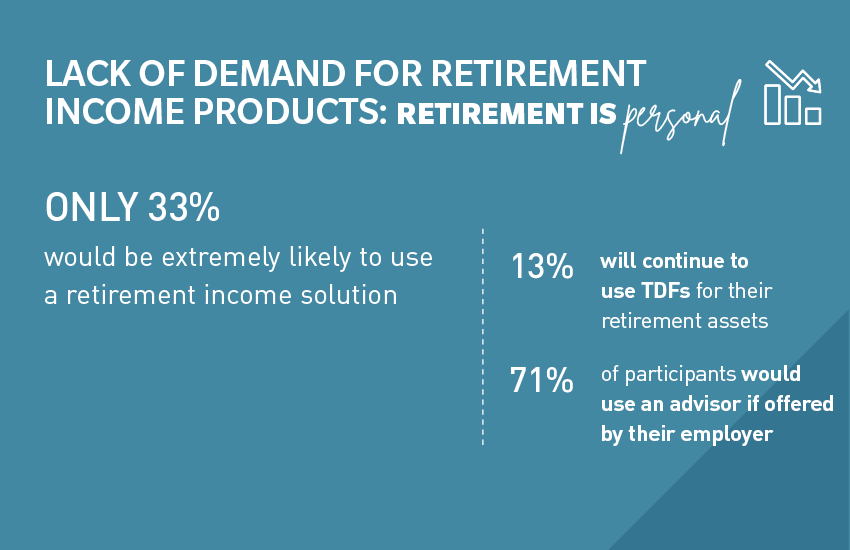

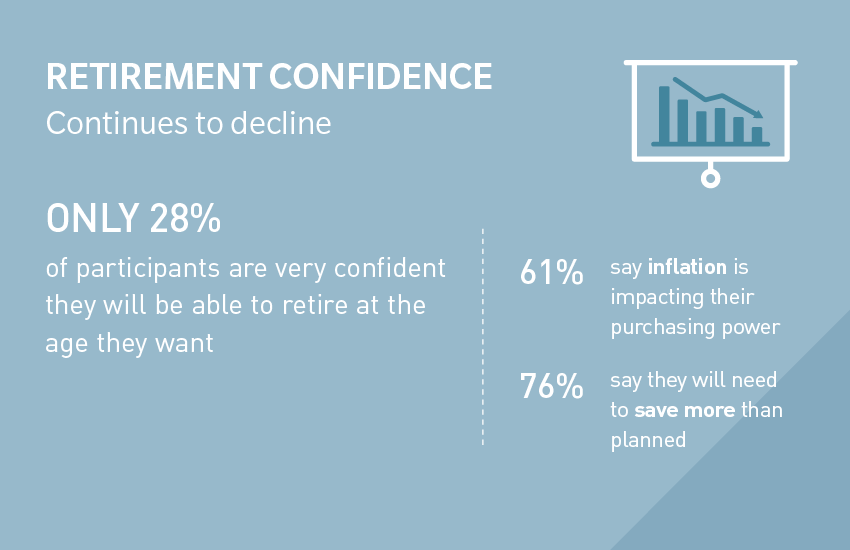

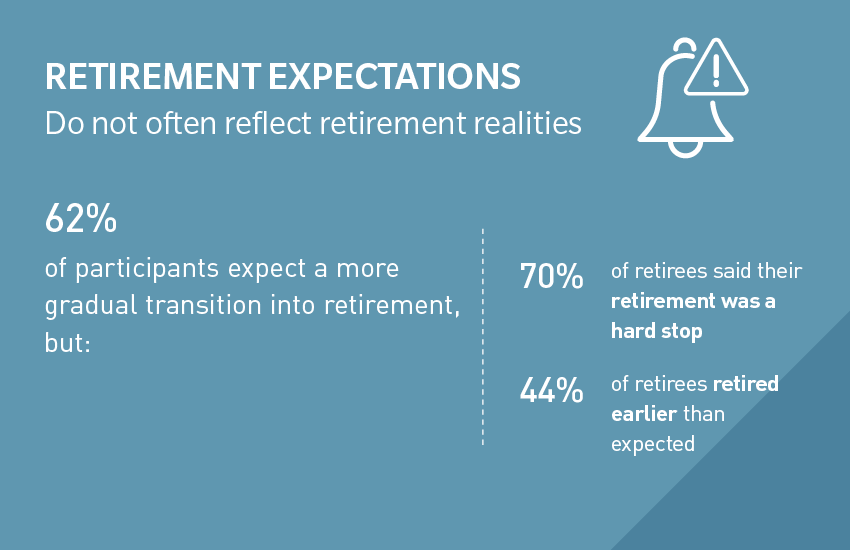

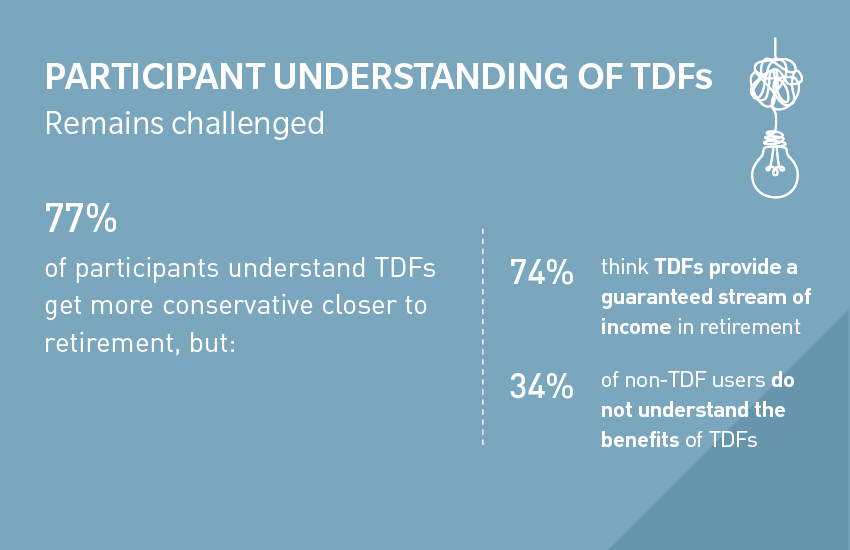

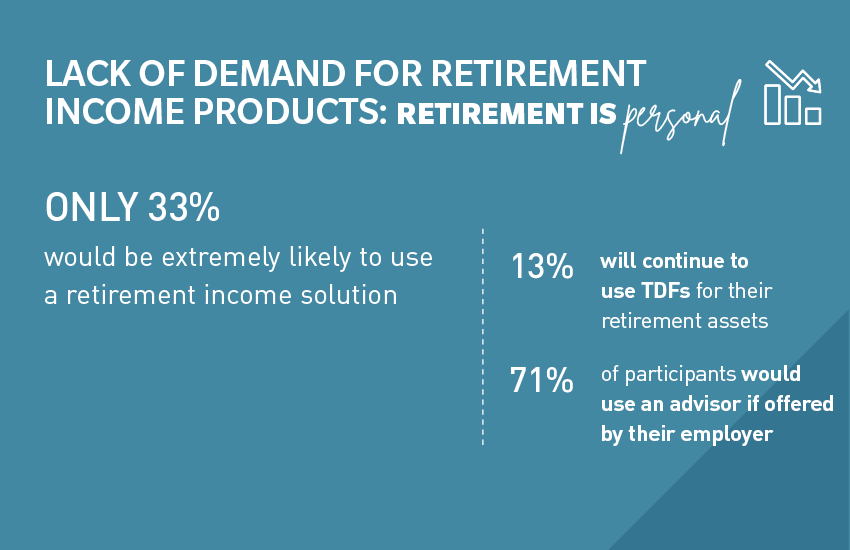

MFS 2025 Global Retirement Survey Results Snapshot

Source: MFS 2025 Global Retirement Survey, US participants and retirees. For survey methodology, please click here.

-

DC Regulatory and Legislative Happenings

DC Regulatory and Legislative Happenings

Executive Order: Alternatives

In early August 2025, President Trump issued “Democratizing Access to Alternative Assets for 401(k) Investors.” The order directs the DOL Secretary to reexamine past and present guidance in making available to participants an asset allocation fund that includes investments in alternative assets and clarify the DOL's position on alternative assets and appropriate fiduciary process, among other orders.

Importantly, the order specifically directs the DOL to “prioritize actions that may curb ERISA litigation that constrains fiduciaries’ ability to apply their best judgment in offering investment opportunities.”

DOL Priorities

In early September 2025, the DOL issued its new regulatory agenda, framed as “a set of high-priority actions designed to reduce unnecessary burdens on employers and employees.”

This agenda is not legally binding, but it does suggest there will be new ESG and fiduciary advice rules to replace two Biden-era rules.

Other items on the agenda include (but are not limited to) reporting and disclosure requirements under SECURE 2.0, guidance on pooled employer plans, auto-portability, ESOPs, and a review of IB 95-1 that could provide additional guidance on pension risk transfers.

Pooled Employer Plans

In late July 2025, the DOL issued a request for information pertaining to pooled employer plans (PEPs) and how to make them more viable for small businesses, allowing for a comment period through September 29, 2025.

According to the guidance, the DOL is seeking comment on the structure and marketing of PEPs, the use of independent fiduciaries to mitigate conflicts, the development of a potential regulatory safe harbor to reduce legal exposure for joining a PEP, and whether further legislation is needed for market growth.

The PEP marketplace is highly concentrated, with the 12 largest PEPs accounting for 70% of all PEP assets and the four largest PEPs accounting for 40% of all PEP assets.

Legislation: Gig and Young Workers

In early July 2025, Senators Bill Cassidy, R-Louisiana, chair of the Senate Committee on Health, Education, Labor and Pensions, Tim Scott, R-South Carolina, and Rand Paul, R-Kentucky, introduced legislation aimed to improve the retirement security of freelance and gig workers through four coordinated bills (Unlocking Benefits for Independent Workers Act, Modern Worker Empowerment Act, Association Health Plans Act, and Independent Retirement Fairness Act).

In late July 2025, legislation was reintroduced in the House that would offer workers younger than 21 access to more retirement benefits (Helping Young Americans Save for Retirement Act).

Sources:

Democratizing Access to Alternative Assets for 401(K) Investors – The White House,

U.S. Department of Labor - Agency Rule List - Spring 2025,

U.S. Department of Labor - Department of Labor solicits public input on ways to help smaller employers improve retirement plan outcomes for workers, U.S. Department of Labor - Department of Labor solicits public input on ways to help smaller employers improve retirement plan outcomes for workers,

U.S. Senate Committee on Health, Education, Labor & Pensions,

Text - H.R.4718 - 119th Congress (2025-2026): Helping Young Americans Save for Retirement Act | Congress.gov | Library of Congress

-

DC Market Data

DC Market Data

The Value of Advice

Particiants indicate they would use an advisor if their employer offered access and see the value of advice when it comes to decumulating their retirement assets.

Sources: The Cerulli Edge, The Americas Asset and Wealth Management Edition, “The 401(k) Participant Issue”, published September 2025 and MFS 2025 Global Retirement Survey, US participants.

-

Investment Index Returns

Investment Index Returns

As of September 30, 2025

Sources:

SPAR, FactSet Research Systems Inc., MFS analysis. Illustrative 60/40 portfolio comprises 60% S&P 500 and 40% Bloomberg US Aggregate and is rebalanced monthly.

This hypothetical example is for illustrative purposes only. MSCI indices shown are net returns.

Cash is based on returns for the FTSE 3-month Treasury Bill Index.

The historical performance of each index cited is provided to illustrate market trends; it does not represent the performance of a particular MFS® investment product. It is not possible to invest directly in an index. Index performance does not take into account fees and expenses. Past performance is no guarantee of future results. You should consider your client’s financial needs, goals, and risk tolerance before making any investment recommendations.

Disclosures

“Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by Massachusetts Financial Services Company (“MFS”). The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ product(s) is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such product(s).

Frank Russell Company ("Russell") is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes.

Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell's express written consent. Russell does not promote, sponsor or endorse the content of this communication.BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Source FTSE International Limited ("FTSE") © FTSE 2022. "FTSE®" is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data and no party may rely on any FTSE indices, ratings and/or data underlying data contained in this communication. No further distribution of FTSE Data is permitted without FTSE's express written consent. FTSE does not promote, sponsor or endorse the content of this communication.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

MFS DC Takes

MFS 2025 Global Retirement Survey Results Snapshot

Source: MFS 2025 Global Retirement Survey, US participants and retirees. For survey methodology, please click here.

DC Regulatory and Legislative Happenings

Executive Order: Alternatives

In early August 2025, President Trump issued “Democratizing Access to Alternative Assets for 401(k) Investors.” The order directs the DOL Secretary to reexamine past and present guidance in making available to participants an asset allocation fund that includes investments in alternative assets and clarify the DOL's position on alternative assets and appropriate fiduciary process, among other orders.

Importantly, the order specifically directs the DOL to “prioritize actions that may curb ERISA litigation that constrains fiduciaries’ ability to apply their best judgment in offering investment opportunities.”

DOL Priorities

In early September 2025, the DOL issued its new regulatory agenda, framed as “a set of high-priority actions designed to reduce unnecessary burdens on employers and employees.”

This agenda is not legally binding, but it does suggest there will be new ESG and fiduciary advice rules to replace two Biden-era rules.

Other items on the agenda include (but are not limited to) reporting and disclosure requirements under SECURE 2.0, guidance on pooled employer plans, auto-portability, ESOPs, and a review of IB 95-1 that could provide additional guidance on pension risk transfers.

Pooled Employer Plans

In late July 2025, the DOL issued a request for information pertaining to pooled employer plans (PEPs) and how to make them more viable for small businesses, allowing for a comment period through September 29, 2025.

According to the guidance, the DOL is seeking comment on the structure and marketing of PEPs, the use of independent fiduciaries to mitigate conflicts, the development of a potential regulatory safe harbor to reduce legal exposure for joining a PEP, and whether further legislation is needed for market growth.

The PEP marketplace is highly concentrated, with the 12 largest PEPs accounting for 70% of all PEP assets and the four largest PEPs accounting for 40% of all PEP assets.

Legislation: Gig and Young Workers

In early July 2025, Senators Bill Cassidy, R-Louisiana, chair of the Senate Committee on Health, Education, Labor and Pensions, Tim Scott, R-South Carolina, and Rand Paul, R-Kentucky, introduced legislation aimed to improve the retirement security of freelance and gig workers through four coordinated bills (Unlocking Benefits for Independent Workers Act, Modern Worker Empowerment Act, Association Health Plans Act, and Independent Retirement Fairness Act).

In late July 2025, legislation was reintroduced in the House that would offer workers younger than 21 access to more retirement benefits (Helping Young Americans Save for Retirement Act).

Sources:

Democratizing Access to Alternative Assets for 401(K) Investors – The White House,

U.S. Department of Labor - Agency Rule List - Spring 2025,

U.S. Department of Labor - Department of Labor solicits public input on ways to help smaller employers improve retirement plan outcomes for workers, U.S. Department of Labor - Department of Labor solicits public input on ways to help smaller employers improve retirement plan outcomes for workers,

U.S. Senate Committee on Health, Education, Labor & Pensions,

Text - H.R.4718 - 119th Congress (2025-2026): Helping Young Americans Save for Retirement Act | Congress.gov | Library of Congress

DC Market Data

The Value of Advice

Particiants indicate they would use an advisor if their employer offered access and see the value of advice when it comes to decumulating their retirement assets.

Sources: The Cerulli Edge, The Americas Asset and Wealth Management Edition, “The 401(k) Participant Issue”, published September 2025 and MFS 2025 Global Retirement Survey, US participants.

Investment Index Returns

As of September 30, 2025

Sources:

SPAR, FactSet Research Systems Inc., MFS analysis. Illustrative 60/40 portfolio comprises 60% S&P 500 and 40% Bloomberg US Aggregate and is rebalanced monthly.

This hypothetical example is for illustrative purposes only. MSCI indices shown are net returns.

Cash is based on returns for the FTSE 3-month Treasury Bill Index.

The historical performance of each index cited is provided to illustrate market trends; it does not represent the performance of a particular MFS® investment product. It is not possible to invest directly in an index. Index performance does not take into account fees and expenses. Past performance is no guarantee of future results. You should consider your client’s financial needs, goals, and risk tolerance before making any investment recommendations.

Disclosures

“Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by Massachusetts Financial Services Company (“MFS”). The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ product(s) is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such product(s).

Frank Russell Company ("Russell") is the source and owner of the Russell Index data contained or reflected in this material and all trademarks, service marks and copyrights related to the Russell Indexes.

Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell's express written consent. Russell does not promote, sponsor or endorse the content of this communication.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Source FTSE International Limited ("FTSE") © FTSE 2022. "FTSE®" is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data and no party may rely on any FTSE indices, ratings and/or data underlying data contained in this communication. No further distribution of FTSE Data is permitted without FTSE's express written consent. FTSE does not promote, sponsor or endorse the content of this communication.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.